How to Save Money on a Tight Budget: A Complete Guide

Struggling to save money when your paycheck barely covers rent, groceries, and bills? You’re not alone—millions of Americans feel the pinch of living on a low income. But here’s the truth: you can save money on a low income with the right strategies and mindset. This guide from MarketGiga.com offers practical, actionable tips to help you build a budget, cut costs, and even grow a small savings account. From smart shopping hacks to side hustles, we’ll show you how to take control of your finances without sacrificing your quality of life. Ready to start building your financial future? Let’s dive in!

Why Saving on a Low Income Is Achievable

The idea that saving is only for high earners is a myth. According to the U.S. Census Bureau, over 40% of Americans earn less than $40,000 a year, yet many manage to save through disciplined habits. The key? Prioritizing expenses, eliminating waste, and setting realistic goals. Saving doesn’t mean giving up everything you enjoy—it’s about making intentional choices. Let’s explore how to make it happen, even on a tight budget.

1. Create a Realistic Budget

How to Build an Effective Budget on a Low Income

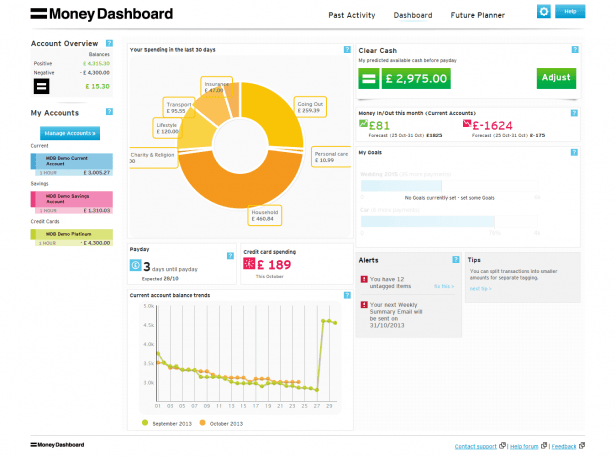

Without a budget, your money slips through the cracks. Start by listing your monthly income and all expenses—fixed (rent, utilities) and variable (groceries, entertainment). Use free tools like YNAB (You Need A Budget) (official site) or Mint (official site) to track everything.

- Practical Tip: Follow the 50/30/20 rule:

- 50% for necessities (housing, food, utilities).

- 30% for wants (dining out, subscriptions).

- 20% for savings or debt repayment. If 20% is too much, start with 5%.

- Example: On a $2,000 monthly income, allocate $1,000 for essentials, $600 for discretionary spending, and $400 for savings or debt.

2. Build an Emergency Fund

Why an Emergency Fund Is Crucial for Low-Income Earners

Unexpected expenses—like car repairs or medical bills—can derail your finances. An emergency fund acts as a safety net. Start small by saving $10-$20 weekly in a high-yield savings account, such as Ally Bank (official site) or Chime (official site).

- Initial Goal: Save $1,000, then aim for 3-6 months of living expenses (e.g., $6,000 if your monthly costs are $2,000).

- Practical Tip: Set up automatic transfers to your savings account to stay consistent.

Financial expert Dave Ramsey notes that 78% of Americans feel less stressed with even a small emergency fund.

3. Cut Costs Without Sacrificing Quality of Life

Smart Ways to Save Money Every Day

Small changes in your spending habits can add up to big savings. Here are some proven strategies:

- Groceries: Shop at discount stores like Aldi or Walmart and use apps like Ibotta (official site) for cashback. Meal planning can cut food costs by 20%, per the USDA.

- Utilities: Lower your electric bill by unplugging devices and using LED bulbs. Switch to a cheaper internet plan with providers like Xfinity (official site).

- Subscriptions: Cancel unused services like streaming or gym memberships. Share plans like Netflix with family to split costs.

Product Recommendation:

Philips LED Light Bulbs (4-Pack) – Save up to 80% on energy costs with these highly rated bulbs. Buy now on Amazon and start cutting your electric bill!

- Product 1: Ultra Definition bulbs are equipped with a color rendering index of 95 (CRI95), bringing out the true colors …

- Product 1: Our LED lights are designed for the comfort of your eyes, meeting our strict criteria for EyeComfort, a stand…

- Product 1: Commitment to sustainability: Signify is committed to creating brighter lives and a better world by reducing …

4. Tackle Debt Strategically

How to Pay Off Debt on a Low Income

High-interest debt, like credit card balances, can eat up your income. Focus on paying off debts with the highest interest rates first (credit cards often exceed 20% APR, per the Federal Reserve).

- Strategy: Use the “debt snowball” method—pay minimums on all debts, then put extra cash toward the smallest balance. Alternatively, the “debt avalanche” prioritizes high-interest debts.

- Practical Tip: Negotiate with creditors for lower rates or use platforms like National Debt Relief (official site) to settle debts.

Over 500,000 Americans reduced debt through negotiation in 2024, according to Experian.

5. Boost Your Income with Side Hustles

How to Earn Extra Money in Your Spare Time

Increasing your income makes saving easier. Explore side hustles that fit your schedule:

- Gig Economy: Drive for Uber (official site) or deliver with DoorDash (official site).

- Freelancing: Offer skills like writing or graphic design on Upwork (official site).

- Selling Items: Declutter and sell on eBay (official site) or Poshmark.

Example: Delivering for DoorDash 10 hours a week can earn $150-$300 monthly, per user reviews.

Comparison Table Suggestion:

| Platform | Type of Work | Avg. Earnings |

|---|---|---|

| Uber | Driving | $15-$25/hour |

| Upwork | Freelancing | $20-$50/project |

| eBay | Selling Items | $10-$200/sale |

6. Invest in Financial Education

How to Master Personal Finance

Knowledge is power when it comes to saving. Educate yourself with accessible resources:

- Books: “The Total Money Makeover” by Dave Ramsey (available on Amazon) is a must-read for budgeting.

- Courses: Platforms like Udemy (official site) offer personal finance courses starting at $15.

- Podcasts: Listen to “The Ramsey Show” or “Afford Anything” for free tips.

A 2023 Forbes study found that financially literate individuals save 12% more annually.

Conclusion

Saving money on a low income is challenging but entirely possible with the right tools and habits. From budgeting with apps like YNAB to cutting costs and earning extra income, every step moves you closer to financial security. Start today: open a high-yield savings account, cancel one unused subscription, or pick up a side hustle. For a head start, try YNAB (official site) to take control of your budget. Don’t wait—your financial freedom begins now!

Product Recommendation

‘The Total Money Makeover’ by Dave Ramsey – Transform your finances with this best-selling guide. Get it on Amazon and start saving today!

FAQ

1. How can I save money on a low income?

Create a budget using the 50/30/20 rule, cut unnecessary expenses, and save small amounts consistently in a high-yield account.

2. What’s the best budgeting app for low-income earners?

YNAB is user-friendly and effective for tracking expenses (official site).

3. How do I pay off debt with limited income?

Focus on high-interest debts first and negotiate with creditors or use services like National Debt Relief.